Get peace of mind knowing you are financially secure.

with Bera Williams

Don’t Let Life’s Surprises Derail Your Financial Security – Get Protected today by Booking a Call with an Insurance Expert

Rated 5 out of 5 from our repeat customers

Mrs. Williams is an amazing agent and I’m so thankful for her. She really took her time and explained all the benefits of having a life insurance policy. I appreciate how thorough she was in her explanations; I was given all the information I needed in order to choose the best policy for myself. She was very professional and made the process seamless. I can’t thank her enough! - Verified purchase

SR- Kansas City, Missouri

Work with Bera ... A top Rated Insurance Expert

Everyone has a need for financial security. When tragedies strike, people want to have peace of mind knowing they are financially secure. Tragedies may hit at any time without advance notice. Insurance can provide financial security so the uncertainty surrounding disaster is alleviated.

Sign up now for your free consultation with Bera today to get a customized insurance advice and plan.

Only 5 Slots Left!

Why Choose Bera for your insurance plans?

- Expertise

I have specialized knowledge and experience in the insurance industry, which allows me to provide valuable guidance and advice on the types of policies that are best suited for your needs.

- Cost Savings

I can help you find the most cost-effective policies that still offer the coverage you need, potentially saving you money in the long run.

- Customized Solutions

I can provide personalized recommendations based on your unique situation, goals, and preferences, helping you find the insurance policies that best fit your needs.

- Simplified Process

I am here to help simplify the insurance buying process by explaining complex policy terms and helping you navigate the application and claims process.

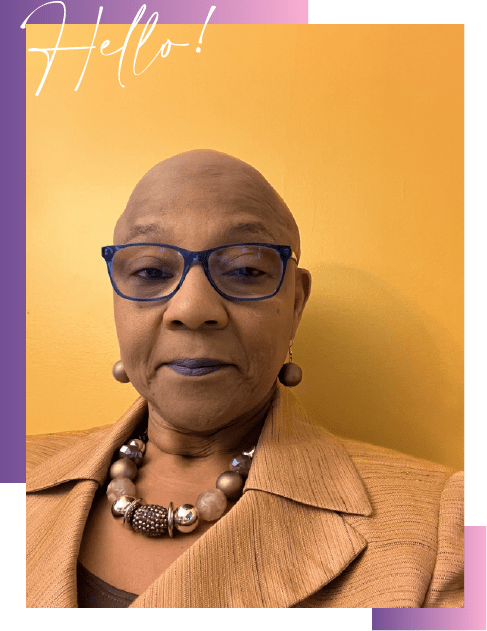

About me

Bera Williams (A top-rated insurance Expert).

Protecting and serving is a passion that was recognized in me by my family as a youth. Proudly served in the United States Army for nine years, and retired from the Federal government, to advocate for women, children, and our elderly in the arena of social services.

Experienced as a Medical Staff Professional with 30 years of service in the military and the private sector within the healthcare arena; as a broker, I work for you in educating you and your families about their need to be prepared in the event of tragedy due to loss of life, injury, or illness; how to build wealth, and to protect their greatest asset’s their family, mortgage/rent and their “earning power.”

Sign up now for your free consultation.

What my Clients

Have To Say About Me

Frequently Asked Questions

Financial insurance, also known as financial protection or insurance, is a type of insurance policy that provides financial coverage and support in the event of unexpected events, such as accidents, illnesses, or death.

There are various types of financial insurance policies available, such as life insurance, health insurance, disability insurance, long-term care insurance, and more. The type of insurance policy that’s best for you will depend on your individual circumstances and needs

The amount of financial insurance you need will depend on various factors, such as your income, assets, debts, and financial goals. It’s important to assess your needs and work with an insurance expert to determine the right amount of coverage for your situation.

The cost of financial insurance will vary depending on the type of insurance policy, the amount of coverage, your age, health status, and other factors. It’s important to shop around and compare quotes from different insurance providers to find the best coverage at a reasonable price.

Financial insurance provides protection and peace of mind in the event of unexpected events that could impact your financial stability. By having the right coverage, you can ensure that you and your family are financially secure and protected against unexpected expenses and losses.